Bubbly Bitcoin - From "Rational Bubbles" to Value Investment

Insights from Top University Professors in China Where Bitcoin is Considered a "Scam"

Recently, I stumbled across an intriguing study from professors of Tsinghua and Peking University—institutions based in a country where Bitcoin is officially banned and commonly labeled a "scam" by the general public—titled "Bubbly Bitcoin" (Dong, F., Xu, Z., & Zhang, Y., 2021). Employing behavioral economics alongside meticulous mathematical modeling, the paper explores a fascinating question: How can Bitcoin, a digital asset with no intrinsic utility, manage to sustain a market price? Beyond emotional speculation, what deeper forces underpin its value?

The paper attempts to address three key questions:

Why does Bitcoin have value? How does sentiment influence its price? What do rational investors see in Bitcoin?

1. Why Does Bitcoin Have Value?

To answer this, we must start with the concept of rational bubbles.

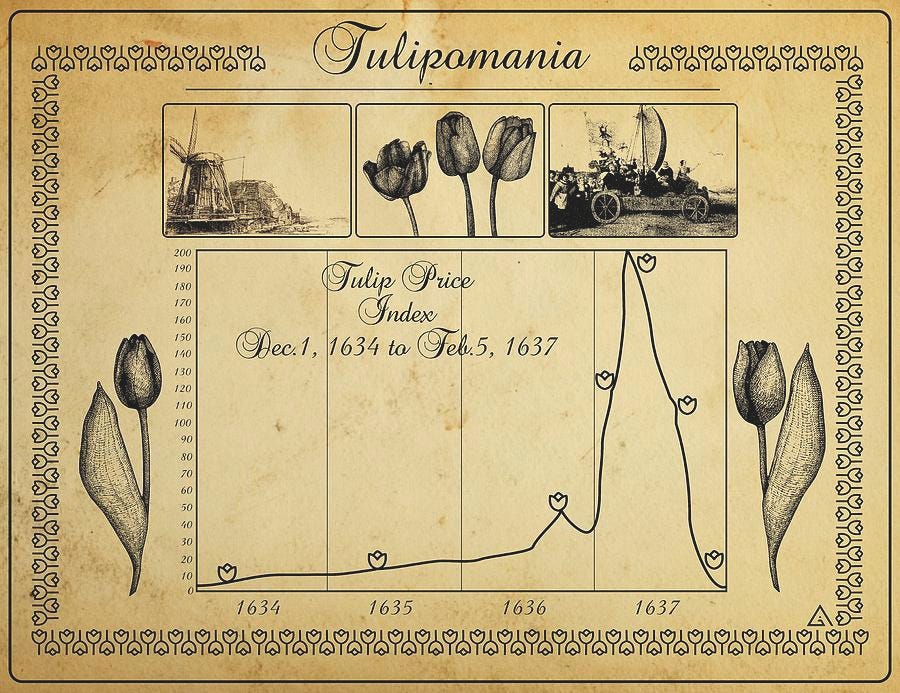

A rational bubble is intriguingly defined as: an asset whose prices do not reflect fundamentals” (Stiglitz, 1990), i.e. its price rises due to investors' expectations of future price increases, despite having no intrinsic fundamental value.

For instance, Bitcoin itself has no practical use or governmental backing, but people buy it because they believe someone else will pay even more in the future. This collective belief pushes prices higher.

When market sentiment is sufficiently optimistic, Bitcoin, fundamentally worthless, can sustain itself as a rational bubble. Such bubbles provide liquidity to real economic investments but also reduce total social output, as they don't generate intrinsic value.

Historical analogies include the real estate and stock market bubbles. Consider Japan in the early 1990s or the U.S. during the Great Recession—real estate prices surged not due to genuine housing demand or rental income but largely due to the simple expectation that prices would keep rising. Once expectations reversed, the bubble burst.

2. How Does Sentiment Influence Price?

In the model presented, "sentiment" is mathmatically defined as the inverse of the probability of bubble bursting.

Simply put:

Negative sentiment indicates higher perceived risk of bubble bursting.

Positive sentiment implies expectations of continued bubble existence.

Interestingly, empirical evidences show positive sentiment has limited impact to Bitcoin’s price, whereas negative sentiment significantly affects prices. For instance, Bitcoin price’s sharp declines following regulatory tightening in 2017-2018 occurred notably within 15 days of negative announcements.

The study also found that during optimistic markets, negative sentiment may depress Bitcoin prices but can stimulate real economic growth as liquidity moves toward more productive uses.

However, in already pessimistic markets, negative sentiment can intensify economic downturns due to reduced market liquidity.

From a societal viewpoint, Bitcoin’s bubble burst could paradoxically enhance overall welfare—reduction in Bitcoin mining activities would free up power and computing resources for productive economic use. However, a critical warning: in an already fragile macroeconomic environment, a large-scale bubble collapse could exacerbate downturns, potentially triggering a severe economic depression.

For instance, amidst the current 2025 global recession expectations due to escalating trade wars, a significant bubble burst could lead to worldwide economic distress.

3. What Do Rational Investors See in Bitcoin?

Bitcoin's price fluctuations largely stem from financial environment differences faced by investors.

Companies face external factors like transaction costs, subsidies, and taxes, directly influencing investment costs. Amid economic uncertainty, businesses need sufficient liquidity to capitalize on future opportunities. Bitcoin emerges as an effective liquidity tool through cryptocurrency’s financial tools, helping manage uncertainty and liquidity constraints.

Thus, businesses willingly pay extra for holding Bitcoin—thus creating liquidity premium. Intriguingly, the greater the external financial shocks, the higher the Bitcoin demand.

In an imperfect financial market, traditional risk-hedging mechanisms often fall short. Hence, investors resort to liquid assets like Bitcoin to enhance flexibility. This growing demand raises Bitcoin's price above its intrinsic value—sustaining a rational bubble due to continued optimistic expectations.

Consider two investor scenarios:

Investor A: A small business owner facing bank lending difficulties and illiquid assets. Rationally, he invests in Bitcoin and borrow cryptocurrency to maintain liquidity, despite acknowledging the risk.

Investor B: A high-income professional with ease of access to traditional financing and less impacted by market imperfections, thus minimal or no Crypto holding.

Outcome:

Rational investors like A elevate Bitcoin demand due to liquidity needs.

Although Bitcoin lacks intrinsic dividends like stocks or bonds, belief in future appreciation forms a rational bubble.

4. 💡Extended Analysis - Does Chinese Economic Growth Influence Bitcoin Prices?

An intriguing observation:

Bitcoin markets in the U.S. and China display contrasting patterns. In the U.S., Bitcoin prices show a counter-cyclical pattern, rising during economic downturns. Conversely, in China, Bitcoin price movement aligns with economic cycles—rising with economic growth and falling during downturns.

Why the divergence?

The research attributes it to investor sentiment. Due to different regulatory environment, U.S. investors tend toward optimism regarding bubble stability, whereas Chinese investors exhibit greater caution and higher risk perceptions.

Specifically:

In an optimistic market (U.S.), negative sentiment redirects funds from Bitcoin to productive investments, improving economic efficiency.

In a more cautious market (China), negative sentiment exacerbates economic anxiety, potentially triggering broader economic issues.

In addition, structurally, China's economy relies heavily on real economic activities, with positive sentiment directly boosting risk appetite (pro-cyclical) hence more liquidity shift towards high yield financial products. Whereas with U.S. dominance in financial market, negative Bitcoin sentiment would boost liquidity toward alternative assets.

5. 💡Extended Analysis - How Do Rational Bubbles Evolve?

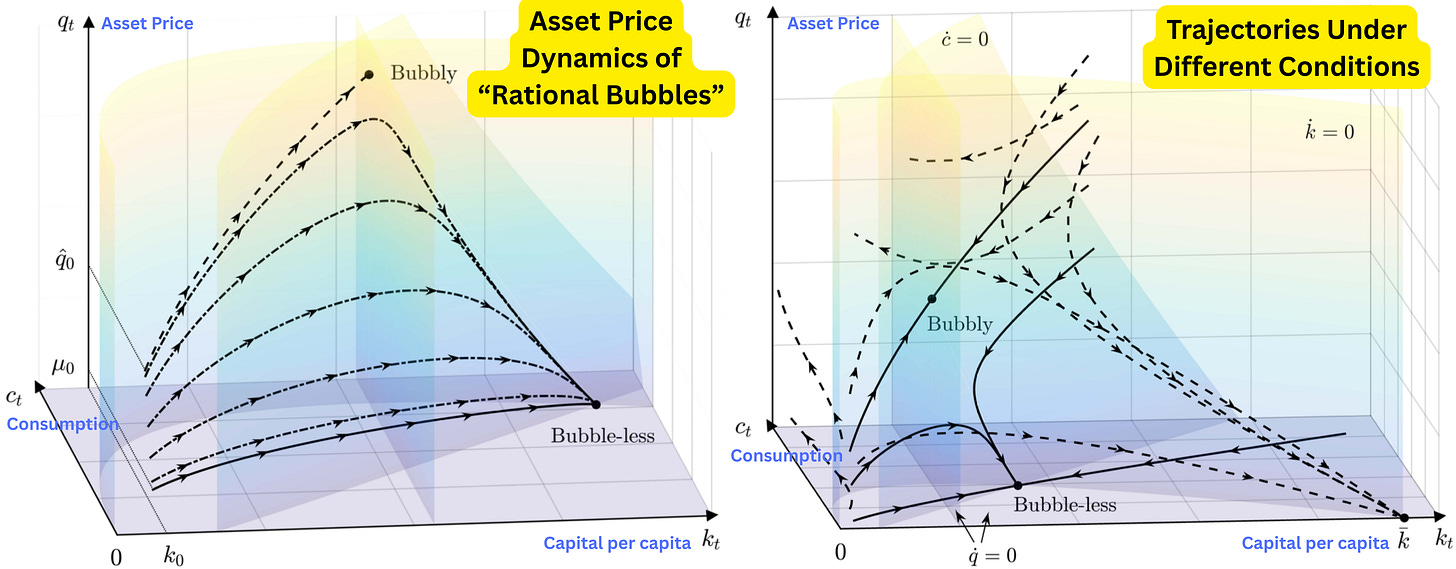

Referring to Michau, Ono, & Schlegl's (2023) paper “Wealth preference and rational bubbles.”, the economic system with rational bubbles demonstrates three states:

Bubble Stability: High asset prices boost perceived wealth, increasing consumption.

Bubble Decline: Prices normalize, stabilizing consumption.

No-Bubble State: Asset prices reflect intrinsic values, stabilizing consumption aligned with income.

Interestingly, bubbles may persist sustainably under certain conditions—a tendency to save, natural interest rates that’s lower than population growth, and declining asset dividend.

Key reasons:

Tendency to save: People inherently value wealth accumulation over immediate spending. This is common in East Asian culture, but less so for consumption-driven economies like the U.S.

Interest Rate < Population Growth: Low risk-free returns from banks drive asset investment as wealth storage.

Declining Asset Returns: Despite decreasing future returns, people buy assets hoping for appreciation, sustaining rational bubbles.

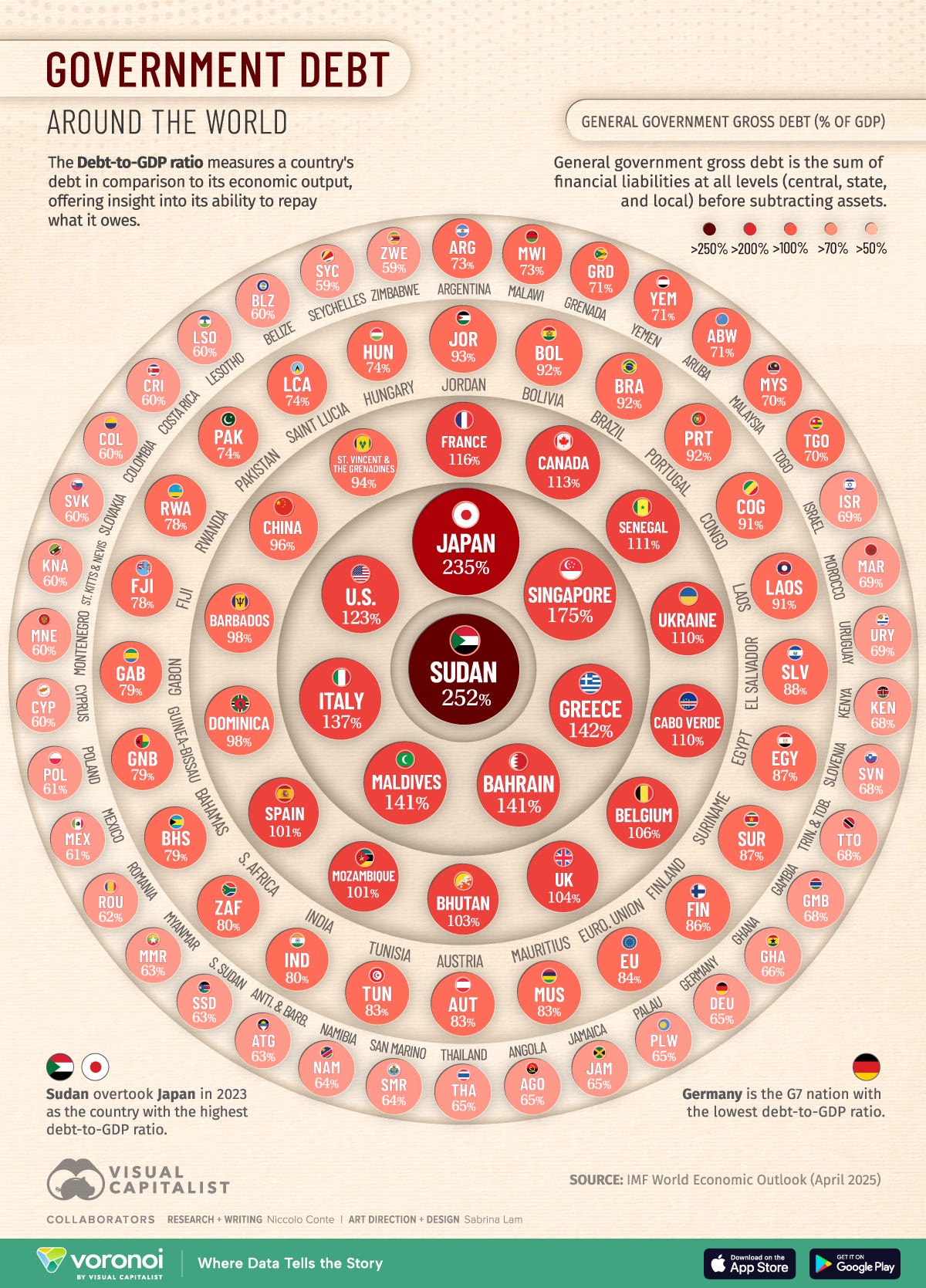

This scenario extends beyond Bitcoin to other assets—Even Japanese government bonds exemplify a rational bubble. High savings, low interest rates, and minimal returns foster an environment where investors maintain confidence, despite debt-to-GDP ratios exceeding 250%.

This illustrates a critical insight: rational bubbles can persist sustainably even in seemingly low-risk, stable and institutionally reinforced environments.

Additional Reading

Daniel Kahneman, author of Thinking, Fast and Slow, passed away in 2024. His groundbreaking work in behavioral economics, awarded the 2002 Nobel Prize, continues to inspire cognitive exploration in the age of artificial intelligence.

References

Dong, F., Xu, Z., & Zhang, Y. (2021). Bubbly Bitcoin. Economic Theory. https://doi.org/10.1007/s00199-021-01389-y

Michau, J.-B., Ono, Y., & Schlegl, M. (2023). Wealth preference and rational bubbles. European Economic Review, 156, 104382. https://doi.org/10.1016/j.euroecorev.2023.104496

Stiglitz, J. E. (1990). “Symposium on Bubbles”. Journal of Economic Perspectives 4.2, 13–18. doi: 10.1257/jep.4.2.13.